Big in Turkey: Even taxi drivers know our names

Burton Flynn and Ivan Nechunaev

October 2023

It was a nice sunny morning in Istanbul. We were in a taxi on a highway, on our way to a company meeting. All of a sudden, our driver’s smartphone started frantically flashing red and green. Instead of closely paying attention to the road, the driver was now attending to his phone every few seconds. It didn’t take us long to realize what was going on: the Istanbul stock exchange had just started trading for the day!

After we succeeded in convincing the driver to devote his focus back to driving, we had an insightful – to the extent possible given our highly limited Turkish and his highly limited English – conversation about the Turkish stock market. This taxi driver from Istanbul knew all the companies we have ever owned in Turkey; he pitched his favorite stocks to us and shared his plans to participate in several upcoming IPOs. He seemed to approve of our current portfolio holdings in the country, managing to tickle our egos lightly. Furthermore, he even recalled reading a translation of a famous blog about Turkish companies written by a Finnish “Married” fund some months ago (“Evli” means “married” in Turkish).

Amazed and amused, we looked out of the cab window and saw a local man on a motorbike next to our car. The man was moving faster than us at over 100 km/h, his helmet visor open. He was operating the bike with his right hand as he was holding a smartphone in his left. The man was looking at his smartphone screen, fully absorbed by what he was seeing – riding the bike was a secondary exercise to him akin to flying on autopilot. We exclaimed, frightened: “What is going on here?!” Our driver proclaimed: “He buy Borsa Istanbul stock market!” Then he started laughing. At least now we understood why the motorbike man’s visor was up – it’s difficult to see stock prices otherwise on a nice sunny morning in Istanbul.

A Turkish man presumably trading stocks while riding his bike at over 100 km/h on a highway in Istanbul, as seen from our taxi window

Driving market liquidity over 100 kilometers per hour

The curious observations from a taxi on the ground in Istanbul showcase one of the two major driving (no pun intended) forces of the substantially increased trading volumes in the Turkish stock market. Trying to beat inflation of over 60%, Turkish citizens open brokerage accounts, buy stocks, participate in IPOs, take on leverage, share ideas on social media, read Finnish emerging markets investors’ blogs, and even conduct collective due diligence on public companies via asset visits or even drone “espionage”. This unprecedentedly upbeat retail investor sentiment was further corroborated in our meetings with several local businesses, including two leading Turkish brokerages which are benefiting tremendously from this modern-day gold rush.

The other major factor boosting market confidence and liquidity is the removal of the election uncertainty overhang after the president – who was re-elected in May for his third consecutive term – finally abolished his monetary policy of keeping low interest rates despite an exceptionally high inflation and hired a new finance minister and a new central bank governor who were given carte blanche to effect an orthodox economic policy with higher interest rates and (hopefully) lower inflation and more stable currency. As a result, investment appetite improved and even the foreign investors sighed a relief and started investing in the country again after years on the sidelines, having registered a streak of nine consecutive weeks of inflows into Turkish equities – something unimaginable just a few months ago.

Sticking to our mantra in Turkey

Regardless of any market noise, hysteria or rally, we have always stuck to bottom-up fundamentals in our investment process since our fund’s inception 10 years ago, and our performance record has proven our approach right. Our investment strategy is very simple: we look for cheap, growing, quality businesses. Turkey has a large number of liquid small-cap companies (on par with Taiwan), some of which are fast-growing high-quality businesses run by highly proficient operators that deliver exceptional results in any economic environment, and given that the Istanbul stock exchange had been abandoned by large investors for a long time, the valuations are very benign. As such, having made 92% in EUR terms on our Turkish investments in 2022, we continue seeing compelling bottom-up opportunities in the market today. As an added layer of protection, we still hedge our lira exposure despite the country’s new economic team’s efforts to stabilize the currency and inflation by raising interest rates – history has shown that these efforts can get flipped on their head overnight by a political decision and catch investors unaware. We rather stick to a mantra: “Hedge the lira, sleep well at night.”

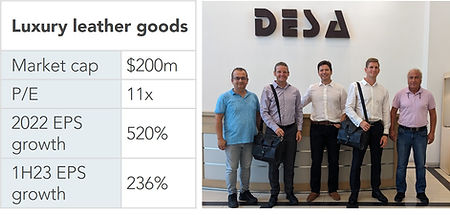

To conduct on-the-ground due diligence on our stock picks amid new economic realities in Turkey, we made a research trip to Istanbul and met with six portfolio companies which are all very cheap and have been growing earnings over 100% in the past several quarters: a $200m luxury leather goods maker which recently started production in Italy; a $200m electrical and solar energy contractor moving into EV charging station manufacturing; a $350m holding which owns the world’s largest cruise port operator; a $100m venture capital investment group which doubles its earnings every year; a $2b brokerage benefiting from the retail trading frenzy; and a $150m diversified investment banking business that partners with Goldman Sachs and serves foreign investors. We were satisfied with our findings and observations.

Outside our hotel on the Asian side of Istanbul at 5 o’clock in the morning before departing for our first company visit

500% returns for waking up at 4 o’clock in the morning

It feels it’s becoming a tradition of ours to visit the premises of a $200m luxury leather goods manufacturer and exporter in very early morning hours on our trips to Istanbul. Last year we met with the CEO at his Istanbul headquarters at 6am, and this time we woke up at 4am and departed our hotel conveniently located on the Asian side of Istanbul at 5am to visit the company’s Duzce factory located 200 km to the east of Istanbul (and of course we had with us our signature business bags made by this company from sustainable Norwegian leather and bought by us a year ago on an unannounced due diligence visit to its store in Antalya). Despite our car’s tire nearly blowing up someplace between Istanbul and Duzce and us having to take a forced but pleasant break filled with flavorful Turkish potato and cheese pastry consumption at a gas station, we still managed to arrive on time for the factory’s opening at 8am thanks to the early-riser CEO who was on his way to the factory an hour ahead of us – having himself departed Istanbul at 4am – but kindly made a U-turn to come pick us up.

Having already visited the company’s sophisticated factories in Istanbul and in Italy on our previous research voyages, we held our expectations for this production facility in the Duzce province equally high – and it did not disappoint. This factory, whose focus is on manufacturing leather goods for luxury Italian brands, was constructed in 2005-2006 and was one of the very first built in the area in the aftermath of the 1999 earthquake. The company had planted trees which now stand very tall (reminding the CEO of his long-term focus when running the business) and installed solar panels – the first and still the only in its industrial zone to do so – which generate surplus electricity. Since opening, the factory has trained over 5,000 local people many of whom had worked in hazelnut plantations before as the supply of job opportunities in the area is rather limited despite the locals’ high willingness to learn a trade and make a decent living. The CEO seemed a bit sentimental when pointing to photos on the wall in the worker canteen depicting how the factory had started in the days past and telling us about the positive impact it has had on local communities, having provided thousands of jobs for the residents of this underprivileged province. Then he quickly turned enthusiastic and mentioned that his company recently bought an adjacent land plot that might be used for capacity expansion in the future which is three times larger than the land under the existing factory.

The CEO gave us a real-life lecture on the ten stages of the leather bag manufacturing process and impressed us with his knowledge of the leather-making craft. An engineer and leather technologist by education, he arranged the factory in such a way that all production stations are on wheels and the entire layout of the factory floor can change in just one hour, incorporating much-needed efficiency to accommodate growing client orders. Speaking of efficiency, the factory also has a workshop that is making custom metal and wooden tools for working with leather, which removes the burden of relying only on buying tools from abroad which can be costly and come with long waiting times. We simply said “Wow!” as we observed over 500 employees skillfully making bags which in a few months will go on sale at prices over $2,000 in cities like Milan and Hong Kong. We were also "wow"-ed when we learned that the company has been buying 50% of the entire Norwegian sustainable sheepskin leather supply for the last 15 years.

The company is on track to double its earnings this year, and with a diversified business model that includes luxury exports, local retail, foreign retail, luxury production in Italy, and a Samsonite joint venture, it stands to weather any type of economic (read: currency) environment very well. We couldn’t be happier with this investment made in mid-2022 as the stock has returned 500% in EUR terms since then. With the Italian factory ramping up quickly and the continuous product innovation and strategic business development executed by the highly capable CEO who is successfully growing the pie for the company's stakeholders, we believe there is more room for profit expansion in the bag. We are certain (and the CEO echoed our perception) that many investors and analysts still misunderstand the company and its growth drivers as they think that the only business it does is its several dozen local retail stores – clearly, this couldn't be farther from the truth.

A fun fact: one of the recent sell-side research analyst reports on this company copied word-to-word the content from our blog about visiting the company’s Italian factory earlier this year. Actually, such a lazy job makes us happy: it tells us that there is so much inefficiency in emerging markets which can be exploited through active management and legwork that it really does pay off to be earlier than others (even if it means waking up at 4am) when looking for hidden gems.

Meeting with the CEO and factory managers of a $200m luxury leather goods manufacturer and exporter

EV charging: Made in Turkey

Coming back from the rural Duzce to Istanbul, the country's largest city with the population of 30 million people (which is six times greater than the entire population of Finland), we met with a $200m electrical and solar energy contracting company our fund has known and invested in for almost a decade. After being introduced by the CEO and shaking hands with all employees in the company’s corporate office on the Asian side of Istanbul with beautiful 360-degree views of the city, the Bosphorus, the sea and the Princes’ islands, we sat down for a lunch meeting with the management. As we were enjoying delicious Turkish grilled food and simultaneously grilling the management of the company with our inquisitive investor questions, the CEO and CFO appeared very happy and in an upbeat spirit. We identified several reasons for this.

First, the original business of the company – electrical contracting – has kept producing strong results. The municipality is building new metro lines, a major telecom provider is building data centers, the government is rebuilding the cities affected by this year’s earthquake, Saudi Arabia awarded $50b in construction contracts to Turkish builders, and domestic investment appetite improved after the presidential elections in May. All of these might bring new business for the company, and the timing couldn’t be better as the competition is very limited while the price of copper – a key component in electrical wiring – is very favorable at the moment, helping the firm maintain its trademark-worthy EBITDA margins over 40%. The company’s backlog is 3x larger than a year ago, and it booked 5x more new jobs in H1 2023 than in H1 2022. It is always a nice bonus to remember that the company fixes 85% of its contracts in EUR terms.

Second, in the last few years the company has been building out a solar energy business. Having entered the solar space with smaller projects of 1-2 MW, it now has a successful track record of execution and is bidding for larger projects of 15-30 MW. Winning just one or two of such substantial projects could significantly increase profits.

Third, a cherry on the cake: the company plans to start manufacturing charging stations for electric vehicles next year. The CEO has set up an EV charging division, hired a team, developed a product prototype, and is very optimistic about this game-charging opportunity which could help his company grow manyfold. If execution goes according to plan, not only will we see these EV charging stations in Turkey but they will also be exported to Europe.

We have been observing this management team at work for a long time and believe they are among the very best in the entire emerging markets universe for their ability to consistently deliver top results for their clients and shareholders. At the moment, it is not easy for the market to understand the whole transformation the company is going through – with the solar business expanding and the EV business starting up – and this is reflected in the company’s valuations. For example, its cheapest peer in the solar or the broader renewable energy space is trading at more than 2x higher valuations. But this relative cheapness makes it even more exciting: it pays off to be early when closing the valuation gaps.

Meeting with the CEO and CFO of a $200m electrical and solar contractor soon to be also an EV charging station manufacturer

Cruise business not doing well

Crossing the Bosphorus and arriving in the European part of Istanbul, we met with the CEO and founder of a $350m investment holding which owns the world’s largest cruise port operator – despite being headquartered in Turkey, it operates 29 ports in 15 countries and generates profits in euros and dollars. After getting on a cruise ship ourselves earlier this year to research the state of the cruise industry inside-out and getting blown away (but luckily not overboard) by the huge positive industry sentiment, we wanted to touch base with the CEO and assess whether his cruise port business is still doing well. And it turned out that it is not doing well… it is doing multiple times better than a mere “well”!

The average occupancy rates of the cruise ships that docked at the company’s ports from January to July this year are as follows: 100%, 103%, 105%, 106%, 98%, 109%, and 116%. The number of passengers that arrived at the company's ports in August was 41% higher year-on-year, and 35% higher than in August 2019 (before the pandemic). Major global publicly listed cruise companies recently released their forward booking numbers, and those are very strong too. There is nothing else we shall add to make a case for the phenomenally hot state of the cruise industry as affluent (and primarily American) citizens unleash their wealth on the seas, cities, and cruise ports of the world.

More than that, the company has just announced that it obtained an investment-grade credit rating and managed to secure refinancing of its pandemic-era loan from a hedge fund with a new long-term loan provided by a consortium of insurance companies. This refinancing will nearly halve the company’s annual interest payments and thus increase its bottom line by millions of dollars per year. This bodes extremely well for the financial success of our portfolio holding, and a very strong traction in some of its other businesses such as asset management, brokerage, and real estate only makes its investment case even more attractive.

We enjoyed hearing the CEO’s stories supplemented by photos on the wall in his office about him meeting Sophia Lauren and the prince of Saudi Arabia. In return, we suggested that he open cruise ports in Saudi Arabia when the massive hospitality projects get developed on the Saudi coast of the Red Sea. We had not expected – and we much appreciated when this experienced CEO said that our blogs remind him of Warren Buffett’s letters – “written from both the heart and the brain”, as he put it. Turns out, it's not just taxi drivers and research analysts who read our blogs in Turkey, but also the CEOs! In all seriousness, knowing that someone reads and maybe even enjoys our musings gives us energy and purpose to keep on writing. If we try to express it in a beautiful way, our ambition is to offer our readers and investors a poetic depiction of the thrill of emerging markets investing.

Meeting with the CEO of a $350m investment holding which owns the world’s largest cruise port operator

Wake up, investor! Earnings just can’t stop doubling

After getting through the narrow streets in the old part of Istanbul and reaching a rooftop cafe in a delicate old building with a magnificent view of the Bosphorus and the city’s landmark – the Galata Tower – we met with the founder and CEO of a $100m venture capital investment group. This company counts 53 Turkish startups in its investment portfolio. However, most investors and even some of the CEOs we met on this trip think it is a computer parts business, because the CEO founded the company as a PC trading business back in 1991 (in fact, many Turks bought their first computer from his firm in the 1990s). Nonetheless, since those days of the past long gone the company has fully transformed into the technology and venture capital investor it is today. The wrong understanding of the business by the market is highly evident to us, and to reflect the true nature of the company’s activities we made an effort to change its description and classification on Bloomberg – every small step counts when we try to unlock shareholder value by reducing market misunderstanding.

For the vast majority of investors, putting a price on this company is challenging also because its high-potential startup portfolio gets valued by auditors only once a year; as such, its quarterly results are meaningless and the “lazy” investors would have to make their decisions whether to invest in the company by looking only at its annual results. However, if one studies the company’s top startups and follows their valuations through media announcements about fundraising rounds on a regular basis, or if one simply subscribes to the company’s CEO’s updates on LinkedIn, it becomes clear that this company is on track to keep doubling its earnings year after year – this year not an exception – after a 4x profit growth in 2022 and a prior 3x profit growth in 2021. This implies that a potential doubling of earnings in 2023 will make this company’s P/E ratio only 3x in just a few months from now when the annual figures are reported, while a potential tripling of earnings could make its valuation a dirt-cheap 2x P/E. A possible IPO of this group’s subsidiary directly responsible for VC investments could unlock additional shareholder value.

We were astonished when the CEO shared with us that the beautiful building with high-quality furnishings on whose rooftop we were meeting used to be abandoned for decades and was recently refurbished through his personal efforts. A devoted citizen of his native city of Istanbul, the CEO’s hobby is to tour and take photos of Istanbul’s historical buildings on the weekends and to write about their history. During one of such “history tours”, he noticed a dilapidated building in the Galata area and decided to purchase it in order to restore and put it into service as a residential building. He has since acquired a total of 11 such storied and beautiful but decayed buildings in Istanbul – all with their own fascinating stories, some are now used as boutique hotels while others as residential buildings or restaurants. The CEO explained to us that it took him 11 years to restore the building where we met, and he studied the building's history from archives and even turned it into a book along the way. This building used to belong to a wealthy family which moved to France in 1930s and then was subsequently forced to scatter throughout the globe during WWII. The CEO found descendants of the family in places from Argentina to India and invited them to Istanbul where a heartwarming ceremony was held in which the family members were presented with a symbolic key to their refurbished building. The CEO managed to bring this family together after nearly 100 years of separation from home and each other – and now they visit Istanbul and their rediscovered family nest every year.

We love how our job entails not only looking for the best companies to invest in, but also meeting people who are truly committed to giving back to their home countries, cities, and communities.

Meeting with the founder and CEO of a $100m venture capital investment group at a rooftop restaurant in a historic building in Istanbul which he helped restore a few years ago

Borsa Istanbul trumps London Stock Exchange

In the commercial district of Istanbul, we met with the CEO of a $2b brokerage business. Thanks to the affiliation with its parent bank which has over 1,000 retail branches, this company benefits tremendously from the epic era of securities trading that Turkey is living through right now as citizens are trying to escape the 60%+ inflation. Here is some fascinating data: four years ago there were about 1 million brokerage accounts in the country, nine months ago there were almost 4 million accounts, and today there are already 7 million stock trading accounts! It takes only 10 minutes to open an account through an online application, and last month Turkey saw an all-time high number of new brokerage accounts opened – over 10% of Turkish adults have access to the stock market now. In addition to the company’s exceptionally solid fixed income and equity trading presence, its other strength is in the warrant trading business where it controls nearly 70% of the local market share; while in 2017 there were around 3-5k warrant investors in the market, at the end of August there were already 140k warrant investors, helping the broker grow its profits like never before.

The ever-increasing trading volumes are also fueled by an ongoing IPO boom, which this company helps underwrite at scale. Dozens of Turkish companies have IPOed since the beginning of the year – from baby toy retailers to doner kebab chains (and two thirds of the newly listed stocks have gone up at least 60% in their first five days of trading!). Borsa Istanbul has even surpassed the London Stock Exchange by IPO volume this year. According to the CEO, given the current post-IPO stock price appreciation phenomenon, there are families making money from IPOs, with every family member across several generations opening a trading account and getting their stock allocation. Rumor has it, there are about 50-60 IPO applications on the regulator’s desk at the moment – given that it will take time to study and process so many applications, such a hefty backlog can keep fueling the IPO rally for a while.

Of course, at some point the music in the market might stop, the lights might go out (or turn from green to red), and many unassuming retail investors might be left with trauma and never log into their brokerage accounts again. As such, the wise tenured CEO who understands the animal spirits of the market very well sees his mission in increasing financial literacy in the country to help prevent severe stock market meltdowns and family dramas.

But for now, stocks only go up!

Meeting with the CEO, CFO and IR of a $2b brokerage

Foreigners are back in town

The last meeting we had on this trip was with the CEO of a $150m diversified investment banking business with activities including M&A and IPO advisory, wealth management, brokerage, and non-performing loan services. Founded by the CEO three decades ago after his studies in the US and a stint at a bank in Turkey, this company has cemented its place as a partner of choice by foreign investors as well as a warrant trading partner of Goldman Sachs in Turkey.

The CEO was optimistic about the developments in his business and in the Turkish economy. Recently, his company together with Goldman Sachs organized an event in New York with Turkey’s new finance minister which was attended by over 100 foreign fund managers. The most influential Turkish business conglomerates joined the event and expressed their uniform support for the finance minister and his economic policy, and the prevailing sentiment among investors regarding the changing economic policy in Turkey was positive. In fact, foreign investors are showing an increased interest in Turkey again: a recent IPO that this company launched last month saw two dozen international long-only funds participate, something that hasn’t been seen for several years, and this summer there was a streak of nine consecutive weeks of positive foreign inflows into the Turkish equity market. In the past, over 60% of the Turkish stock market was owned by foreign funds; today, this figure is just over 30% – if the inflows continue, it could help the market rerate from its currently cheap valuations.

All business lines of the company are doing well, and guessing by the CEO’s cheerful spirit we would not be surprised to see the company’s earnings guidance upgraded after the Q3 results – the company has a pleasant chronic tendency to underpromise and overdeliver, and we believe this time will be no exception. There are several earnings growth drivers for the company now which were not in place before the presidential elections. First, recently relaxed currency and structured product regulations allow the firm to deal in more products and in greater volumes. Second, increased market liquidity and foreign investor interest in Turkey as well as the IPO boom benefit the company as the go-to partner for foreign investors, the market leader in block trading, and the IPO bookrunner. Third, there are substantial improvements in NPL collection given that with currency depreciation it is now more affordable for people to pay off their loans. And fourth, any future M&A deals due to improved business sentiment in Turkey can significantly boost the company’s financials.

Meeting with the founder and CEO of a $150m diversified investment banking business

Essence of life in a bag

As we were walking with the investment banking CEO through his office toward the exit, we saw a sculpture in the hall: a forward-leaning determined, thoughtful, slightly puzzled and slightly tired man in a business suit holding a travel bag, his body missing a part. We were mesmerized by this sculpture and stood still by it, looking at it as if we were looking in the mirror.

The CEO, who is an art connoisseur, explained to us that this artwork comes from the original series of sculptures named Travelers by Bruno Catalano, an artist born to a Sicilian family in Morocco who moved to France and worked in the seas in his youth. In a way, this sculpture symbolizes its author’s life path as a traveler, a nomad, a seaman, an immigrant, an artist. It strikes a chord with anyone whose life is filled with travel and immigration – be it forced or intentional – full of hope and aspirations but also fears and losses, and of course – stories.

We thought to ourselves that this sculpture epitomizes our essence: Emerging markets investors traveling the globe in search of hidden gems, a part of our souls always missing as it’s forever left behind in the places where we were born, where we have lived, studied and worked, where our friends and families are, in the places we have visited – from Istanbul to Dhaka to Jakarta to Santiago… – but our travel bags are always full of ideas, memories, contacts, stories and anecdotes we can share with others for brief moments of fun, sentiment, introspection, happiness and enrichment which make up our common being.

If we look at our careers as emerging markets investors through this prism found by us by chance in an investment banking office in Istanbul, they gain a very wholesome purpose: to comprehend the beauty of emerging markets and to share it with others.

And of course, besides the fascinating stories and inspiring people, from an investment perspective the beauty of emerging markets is in their inefficiency and alpha potential, which we would like to share with our investors in the form of our fund's stellar long-term performance.

A sculpture in the investment bank’s CEO’s office that epitomizes very well the essence of emerging markets investors traveling the globe in search of hidden gems

Teşekkürler!

Our meetings on this trip reinforced our conviction in our bottom-up stock picks in Turkey. These companies operate in different industries, yet they have three things in common. First, they trade at very cheap valuations between 5-11x LTM P/E. Second, they can grow earnings over 100% this year. And third, they are run by highly proficient managers with significant skin in the game and time-tested ability to grow the pie for their companies’ stakeholders. Given that the Turkish lira is well-known to depreciate over time, we made sure to hedge our currency exposure when investing in these gems.

Our trip went by in a swirling fashion, and what remains of it are our elaborate investment ideas and stories of impressive CEOs and amusing situations on the ground.

Teşekkürler for the unforgettable meetings and taxi rides, Istanbul. Until next time!